Captain’s Post #19 - Update on Property Tax Appeal

Well, I hope you all had a Merry Christmas. As promised here is an update on the Property Tax Appeal. It has been an interesting few months. I believe you all know by now that I am very upset with the County of Marin, specifically by the Marine Division of the Assessor’s Office, and let’s also mention my County Supervisor who would not even return an email. I will mention that there have been a handful of people I have dealt with that have been very nice and helpful.

In the last post I gave an explanation to what has occurred over the last 2 years with the Assessor and now I will give an update on the August hearing that was for my 2024 tax assessment on Independence.

Before I forget, Hello Ric Rosales (the Marine Assessor I have been dealing with), since your minion mentioned visiting the website!

One week before the December 12th hearing of my 2023 assessment of Independence I received an email from the Marin Assessment Appeals Board stating that the Assessor was requesting a postponement of the hearing on the 12th. That was the last thing I wanted, a postponement to February or March, I declined. Within an hour or so I received a ruling about my 2024 assessment that said I would now be assessed at the reduced rate of $1,500,000. However, the specifics were left out regarding whether Sales Tax was being added or not, a sizable difference. Either way, I felt some form of victory, as now I had spoiled Rosales’ self-reported “perfect record of never losing a case”. His attempt at intimidation failed.

I had done a tremendous amount of preparation for the Dec 12th hearing, countless hours, I was ready, maybe too ready. Jamie and I arrived at 8:45AM and we did not have our hearing until 3:30PM. I must say, it was very interesting hearing the other cases that all involved real estate (houses/condos). I found the Assessor for Real Estate to be quite reasonable and at times very sympathetic, as he tried to work with the homeowners. He spent hours at an elderly gentleman’s home (our assessor refused to make an in-person inspection of the wear and tear on our boat). I started to like this assessor, as he was very reasonable and I must say accommodating. After the lunch break we were walking back to the hearing at the same time, and I told him I thought he had a tough job and how I thought he was very nice to that man.

Now our story. As mentioned, we were not heard until 3:30PM, the last case of the day. I started off by reading my rights as a taxpayer. Within a few minutes I was told by the ranking Appeals Board member to speed it up, as “we have this in writing you don’t need to read it”. I went on to present my case, we were appealing the assessment value of Independence, the penalty and the interest charge.

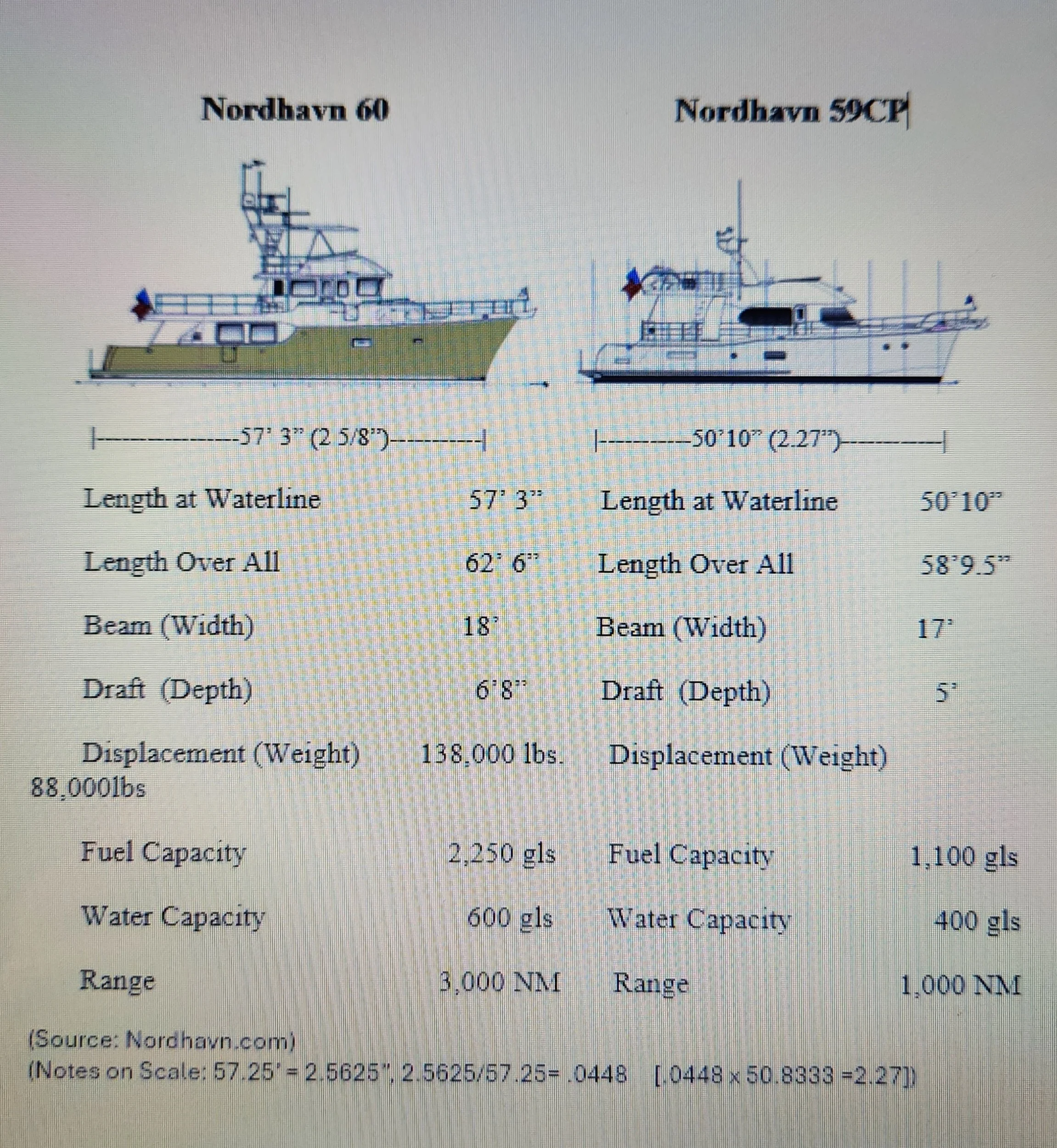

For valuation, I had very detailed drawings comparing my boat, a 59-foot Nordhavn Coastal Pilot, to a 60-foot Nordhavn trawler, which is what the (Marine) Assessor used as a comp in August. The 60-foot is totally different in many ways, principally weighing 69 tons vs ours at 35 tons, almost twice as much (see comparison in the image included). Also, in August the Assessor claimed that inboard boats had appreciated 49% in 2021 according to JD Power. I found the exact document after the hearing therefore no chance to counter, as ‘Apelets’ are not given the opportunity of discovery of material used by the Assessor, thus no way to counter his claim in the August hearing. The JD Power report referred to inboard boats, such as wake and water ski boats, and the Assessor used them as comparables! I showed pictures of those inboard boats, Malibu, Supra, Correctcrafts, etc. and mentioned how they could fit in your garage.

I was told by the board to speed it up again.

I presented Mr. Rosales’ “evidence” from August where he said the Buck Book (a company that puts out values of boats) valued the boat at between $2.06 million and $2.235 million, I asked how can that be? No Nordhavn 59 had sold for more than $1.85 Million, also we owned the only 2016 Nordhavn 59, which we paid $1.575 Million for. The math does not work!

I was told by the board I only had 10 minutes left.

I was mad, I protested. I read the rest of my presentation as fast as I could, furiously and loudly into the microphone, at times yelling in frustration to emphasize a point.

I protested the penalty. In foresight, I had taken a screenshot of the Assessor’s Question and Answer page. It said that they get the information on who owns boats, not me having to tell them…” until just before the August hearing when they changed the web page to ‘if you own a boat you have to inform them’.

I finished in about 8 minutes. It was time for the Assessor to ask me questions and then to give his presentation. I guess Mr. Rosales did not want to lose another case because they brought in another person to give their presentation. He brings up the JD Power report again!!! I couldn’t believe it, was he napping just minutes ago? He dragged on and on, attempting to overwhelm with a large stack of paper. When he was done, one Board Member asked if they could just eliminate the penalty immediately. The Assessors said they were not legally able to eliminate the penalty and that the board will have to decide during their Advisement Period.

As the meeting was winding down the Assessor asked the Appeals Board if the lowering of the value to $1.5 million for my 2024 assessment included Sales Tax. The Chairman of the Board said that they need to have their lawyer review that. In my mind it is simple, the California Constitution states that Personal Property Tax is to be taxed at 1% and the assessed value is what a person could sell their property at on the lien date in an arm’s length transaction.

The Appeals Board had 4 months to render their decision for the August hearing which was Dec 13th. They now have an additional 2 months to give me the written decision which I paid an additional $250 for. I will keep you updated.